Victoria MLS sales continued its record setting pace in March with Greater Victoria home sales reaching 1173 units surpassing the previous March record by 565 sales. Sales were once again propelled to new heights by a sweltering pace of activity across the Capital Region. Total unit sales were up by 52% this March although total active listings were down falling by 58% compared to this time last year. There’s a lack of resale inventory thus putting Victoria in a robust Seller’s market territory.

VREB News Release: The fast pace of Victoria real estate market surges on

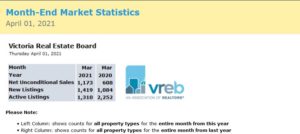

A total of 1,173 properties sold in the Victoria Real Estate Board region this March, 92.9 per cent more than the 608 properties sold in March 2020 and 35.9 per cent more than the previous month of February. Sales of condominiums were up 111.8 per cent from March 2020 with 377 units sold. Sales of single family homes were up 88.2 per cent from March 2020 with 574 sold.

“Limited supply with overwhelming demand has been the story for the first quarter of 2021,” said Victoria Real Estate Board President David Langlois. “This time last year was the beginning of the pandemic and most everything was shut down – so we cannot compare year over year numbers – but if we look at longer term trends, the average number of sales from the month of March in the past ten years before 2020 was 715 properties. Numbers from last month are close to the market trends we saw in 2016, but with an even greater imbalance in inventory due to a surge in consumer demand for homes in the Victoria area.”

There were 1,310 active listings for sale on the Victoria Real Estate Board Multiple Listing Service® at the end of March 2021, 41.8 per cent fewer properties than the total available at the end of March 2020 and 0.6 per cent properties fewer than the 1,318 active listings for sale at the end of February 2021.

”The underlying issue is a deficit in supply,” explained Langlois. “Supply needs to be addressed by all levels of government and particularly by local governments which control land use policies and development processes. Equally important, governments need to ensure that measures they make to moderate the housing market do not exacerbate the problem by attempting to suppress demand by adding costs or qualification barriers. These sorts of measures raise the overall cost of housing and add even more challenges for first time buyers. We need to continue to push for both increased supply and sensible government policies around housing.”

The Multiple Listing Service® Home Price Index benchmark value for a single family home in the Victoria Core in March 2020 was $879,600. The benchmark value for the same home in March 2021 increased by 10.1 per cent to $968,700 a 2.2 per cent increase from the previous month of February. The MLS® HPI benchmark value for a condominium in the Victoria Core in March 2020 was $531,800, while the benchmark value for the same condominium in March 2021 remained close to last year’s value at $529,100 a 0.5 per cent decrease.

Read the statistics package here.